Loading

Get C1201a Bdac - Hm Revenue & Customs - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C1201A BDAC - HM Revenue & Customs - Hmrc Gov online

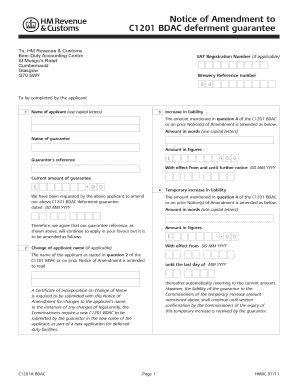

This guide provides clear steps to assist users in effectively completing the C1201A BDAC form, necessary for amending deferment guarantees with HM Revenue & Customs. Follow these instructions to ensure a smooth and accurate submission process.

Follow the steps to complete the C1201A BDAC form online.

- Click ‘Get Form’ button to access the C1201A BDAC form and open it in the editor.

- Complete the applicant's name in capital letters in the designated field.

- Indicate the increase or decrease in liability by filling in the amount in figures and words in the respective fields.

- Provide the guarantor's name and reference number, ensuring accuracy.

- Specify the effective dates for the changes in liability, using the DD MM YYYY format.

- If applicable, indicate any changes to the applicant name and provide a Certificate of Incorporation if necessary.

- Complete the guarantor's address and contact information, ensuring it is written in capital letters as required.

- Sign the form, indicating the status of the signatory alongside the date.

- Review all provided information for accuracy before submission.

- Once completed, save the changes, and choose to download, print, or share the form as needed.

Complete your C1201A BDAC form online to ensure efficient processing of your application.

A duty deferment account (DDA) allows importers to delay paying customs excise duties and import VAT for up to six weeks from import. This enables goods to be cleared without being delayed pending payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.