Loading

Get What Is A 592 B Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A 592 B Form online

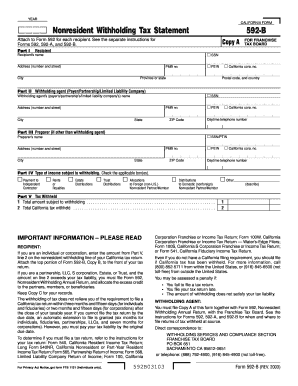

The What Is A 592 B Form is a crucial document used for reporting nonresident withholding tax in California. It is essential for both recipients and withholding agents to understand how to correctly complete this form online, ensuring compliance with state tax regulations.

Follow the steps to accurately complete the What Is A 592 B Form online.

- Click ‘Get Form’ button to obtain the 592 B form and open it in the editor.

- In Part I, provide the recipient's information. Enter their name, Social Security Number (SSN), address, and Federal Employer Identification Number (FEIN). Make sure all details are accurate.

- In Part II, fill out the withholding agent's information. This includes entering the agent's name, SSN, FEIN, and address. Verify that all data is correct to avoid delays.

- In Part III, if applicable, complete the preparer's information if it differs from the withholding agent. Input their SSN or PTIN, name, and address.

- In Part IV, indicate the type of income subject to withholding by checking the appropriate boxes for categories such as payments to independent contractors, rents, and royalties.

- In Part V, report the total amount subject to withholding and the total California tax withheld. Accuracy in these figures is important to ensure proper reporting.

- Review all sections of the form for accuracy. Once all information is confirmed, you can save your changes, download, print, or share the completed form as needed.

Complete your forms online today for efficient tax reporting.

You report form 592-B by sending it to the California Franchise Tax Board along with the corresponding 592 form. This step is crucial for reporting any withholding amounts accurately. Knowing where to report a 592 B form ensures that you stay compliant with state regulations and helps you avoid potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.