Loading

Get Iht100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IHT100 online

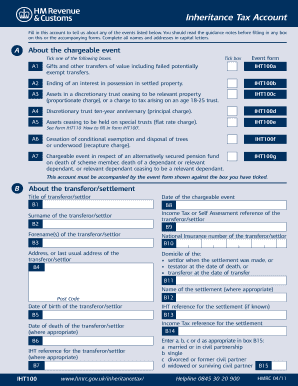

The IHT100 form is a crucial document for reporting chargeable inheritance tax events. This guide will provide you with clear and supportive instructions on how to navigate and complete the form accurately, ensuring compliance and easing your filing process.

Follow the steps to fill out the IHT100 with ease.

- Press the ‘Get Form’ button to obtain the IHT100 form and open it in your preferred online editor.

- Begin with Section A, where you will indicate the chargeable event by ticking the appropriate box. Choose from options such as gifts, ending of an interest in possession, or discretionary trust events.

- In Section B, provide the details of the transferor or settlor including their title, full name, address, and other required identification details.

- Complete Section C with the contact information of the person to whom communication regarding the form should be sent. Be sure to include their name, address, and phone number.

- For Sections D, E, and F, provide details about the relevant assets and liabilities involved in the transfer. Ensure you include accurate values and descriptions as prompted by the form.

- Proceed to Section G for the summary of the chargeable event. You may calculate tax here or leave it blank if you prefer not to perform the calculation.

- In Section H, if you are calculating tax, provide the necessary figures. Complete all related fields carefully according to the guidelines.

- Finalize by reviewing the declaration in Section L. Ensure all persons involved sign and date the form. This confirms the accuracy of the information provided.

- Once completed, save any changes, download, print, or share the filled form as necessary based on your needs.

Start filling out the IHT100 online today to ensure timely submission.

The exit charge calculation requires that all of the property added on the same day is included in the notional transfer so that the effective rate of tax will be the same as if the property had been comprised in just one trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.