Loading

Get Iht100a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht100a online

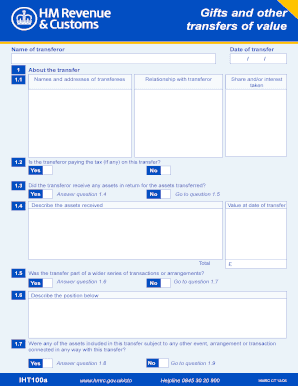

The Iht100a form is essential for reporting gifts and other transfers of value. Completing this form accurately online ensures compliance with inheritance tax regulations and simplifies the process for the user.

Follow the steps to expertly complete the Iht100a form.

- Click 'Get Form' button to access the Iht100a form and open it in your editor.

- Fill in the name of the transferor as it appears on official documents. Ensure all personal information is accurate.

- Enter the date of transfer in the specified format (DD/MM/YYYY). This is crucial for determining the tax implications.

- Provide details about the transfer, including the names and addresses of the transferees. Ensure that this information is complete and precise.

- Indicate whether the transferor received any assets in return for the assets transferred, answering 'Yes' or 'No'.

- Describe the assets received along with their values at the date of transfer to maintain clarity.

- Address any questions regarding previous transfers and indicate if the transferor has made other gifts during the relevant time frame.

- If applicable, complete sections regarding gifts with reservation, taper relief, relief on successive charges, and double taxation relief.

- Review all provided information for accuracy and completeness before final submission.

- Once finished, save your changes, and proceed to download, print, or share the completed form online.

Complete your Iht100a form online today for a seamless process.

Cash, investments or property held in a trust sit outside of your estate for inheritance tax purposes, and can therefore help you avoid an inheritance tax bill. You may want to set up a trust for your children, grandchildren, or other family members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.