Loading

Get Vat431c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat431c online

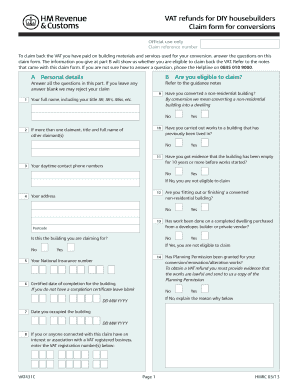

Filling out the Vat431c form is a crucial step for claiming VAT refunds on conversions of non-residential properties into dwellings. This guide will walk you through each section of the form with clear instructions to ensure a smooth online submission.

Follow the steps to complete your VAT431c claim form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal details in Part A, including your full name, address, and contact information. Ensure all fields are completed accurately, as leaving any blank may delay your claim.

- In Part B, determine your eligibility by answering questions regarding the conversion of the non-residential building. Be sure to check for the 10-year vacancy rule and planning permission details.

- For Part C, describe the property that has been converted. Include details like the type of building, number of storeys, and intended occupancy.

- In Parts D, E, and F, list all invoices for the goods and services for which you are claiming VAT back. Ensure each invoice is documented accurately, indicating the VAT amounts, and remember to send the original copies.

- Use the checklist in Part G to confirm that you have included all necessary documentation and that your claim is complete.

- Sign and date the declaration to confirm the accuracy of the provided information, then save changes to your completed form before sending it.

Start filling out your Vat431c form online today to claim your VAT refund!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can't claim overpaid VAT So if you're doing a conversion, e.g. a barn conversion, you can only claim VAT on contractors' invoices if it's the right amount of VAT. In other words, if your contractor charges 20% for work that is eligible for 5%, then you can't claim ANY of the VAT on those services.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.