Loading

Get Application To Cancel Your Vat Registration Before You Complete This Form Please Ensure That You

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the application to cancel your VAT registration online

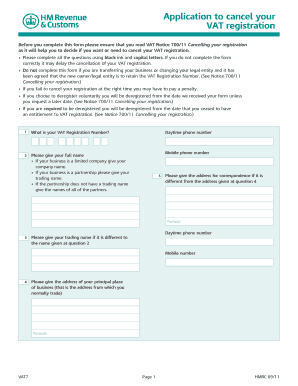

Filling out the application to cancel your VAT registration can be a straightforward process if you follow the necessary steps carefully. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your application

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your VAT registration number in the designated field. This is essential for processing your application.

- Enter your full name. If your business is a limited company, use the company name. For partnerships, provide the trading name or names of all partners if no trading name exists.

- Fill in your daytime and mobile phone numbers to ensure that you can be contacted if necessary.

- If the correspondence address differs from your primary address, indicate the corresponding address here, along with the postcode.

- Indicate the reason for applying to cancel your registration by ticking only one box. This includes options such as ceasing to trade or having taxable turnover below the deregistration limit.

- If applying based on reduced turnover, provide the expected value of your taxable supplies in the next 12 months and any details that justify this expectation.

- Answer all relevant questions about your taxable supplies and provide required dates, ensuring that all information is accurate to avoid delays.

- Complete the declaration section, ensuring that it is signed and dated by the appropriate person, such as a business owner or partner.

- Submit the completed form to the specified address for processing. Ensure you retain a copy for your records.

Start the process of cancelling your VAT registration online today!

Related links form

If you wish to cancel your VAT registration, please contact your Revenue office. If you fail to do so, return forms and demands for estimated VAT liability will continue to issue automatically. Revenue may also cancel your VAT registration if your registration is not appropriate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.