Loading

Get General Application For Rebate Of Gst/hst - Agence Du Revenu Du ... - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

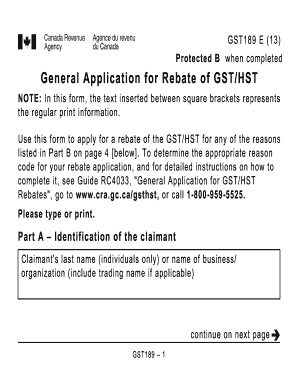

How to fill out the General Application For Rebate Of GST/HST - Agence Du Revenu Du ... - Cra-arc Gc online

Filing the General Application for Rebate of GST/HST can be a straightforward process when you have clear guidance. This guide provides step-by-step instructions for completing the form online, ensuring that you can access potential rebates easily.

Follow the steps to successfully fill out the GST/HST rebate application form.

- Click ‘Get Form’ button to obtain the General Application for Rebate of GST/HST and open it in your document editor.

- In Part A, provide the required identification information such as the claimant's last name or the name of the business or organization, followed by the first name and initials if applicable. Ensure to include your business number, mailing address, city, province, and postal code.

- Indicate whether your address has changed since your last application. If yes, specify if you would like the file updated. Additionally, decide whether this application amends a previous application.

- Select your preferred language of correspondence — English or French — and indicate the period covered by the claim by filling in the starting and ending dates.

- Move to Part B and tick the appropriate box that corresponds to the reason for your rebate request. It is crucial to tick only one box for each application; additional reasons require separate forms.

- In Part C, Section I, you will complete the rebate calculation based on the amounts being claimed. Ensure you follow the instructions from the form and add any necessary documents in support of your claim.

- Fill in Part D if a third party is filing this application on your behalf, ensuring that the information matches what was provided in Form GST507.

- Sign and complete Part E to certify that all information provided is accurate. This includes acknowledgment of retention requirements for documents related to this rebate application.

- If applicable, complete Part H for direct deposit requests. Ensure that proper authorization is provided in this section.

- Finally, review your completed application for accuracy and clarity. You may now save your changes, download the form, print it out, or share it as needed.

Begin your application for the GST/HST rebate online today!

you are at least 19 years old. you have (or had) a spouse or common-law partner. you are (or were) a parent and live (or lived) with your child.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.