Loading

Get Sba Form 4, Schedule A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to.fill out the SBA Form 4, Schedule A online

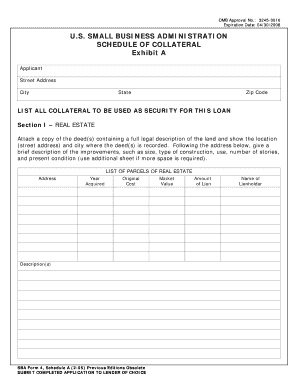

The SBA Form 4, Schedule A is a critical document for applicants seeking a loan through the U.S. Small Business Administration. This guide provides step-by-step instructions on how to complete the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete the SBA Form 4, Schedule A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your information in the 'Applicant' section, including your name, street address, city, state, and zip code.

- In Section I, 'Real Estate', list all properties to be used as collateral. For each property, provide the address, year acquired, original cost, a brief description of the property that includes the size, type of construction, use, number of stories, and present condition.

- Attach a copy of the deed(s) with a full legal description of the land. Make sure to indicate where the deed(s) is recorded.

- Proceed to Section II, 'Personal Property'. Here, list all items with an original value greater than $5,000. For each item, include the manufacturer, model, year, and serial number. Clearly identify items without a serial number.

- For each personal property item, provide the year acquired, original cost, market value, current lien balance, and name of the lienholder.

- Review the entire form to ensure all provided information is true and correct. Make corrections as necessary.

- Once you have completed the form, save your changes. You can then download, print, or share the form as needed.

Complete your SBA Form 4, Schedule A online today to ensure your loan application is submitted accurately and efficiently.

It can be difficult to get an SBA 7(a) loan if you don't have strong annual revenue, a good credit score (690+) and at least two years in business. SBA 7(a) loan requirements vary from lender to lender, but you'll generally need to meet these criteria to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.