Loading

Get Who Has To Fill Out A Florida Form Rts 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Who Has To Fill Out A Florida Form Rts 3 online

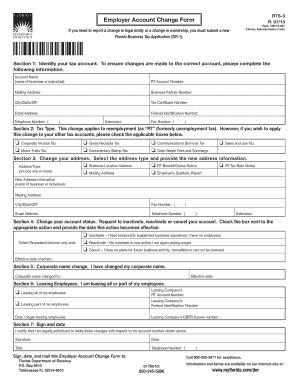

Filling out the Who Has To Fill Out A Florida Form Rts 3 online is essential for employers to report changes in their tax accounts. This guide provides a clear, step-by-step approach to ensure that you complete the form accurately and efficiently.

Follow the steps to complete your form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, identify your tax account by providing your account name, RT account number, mailing address, business partner number, city/state/ZIP, tax certificate number, email address, federal identification number, and telephone number.

- In Section 2, specify the tax type this change applies to. Indicate if it pertains to reemployment tax and check any additional applicable tax types.

- In Section 3, update your address by selecting the address type and providing the new address details, including your business or individual name, mailing address, city/state/ZIP, fax number, email address, and telephone number.

- In Section 4, change your account status by selecting one of three options: inactivate, reactivate, or cancel your account. Provide the effective date for this action.

- In Section 5, if applicable, indicate any change to your corporate name and provide the new corporate name along with the effective date.

- In Section 6, if leasing employees, specify if you are leasing all or part of your employees and provide the required information, including the leasing company's RT account number or federal identification number and the date you began leasing.

- In Section 7, certify that you are authorized to make these changes by signing and dating the form, and include your title and telephone number.

- Finally, you can save changes, and download, print, or share the form for submission. Mail the completed form to the Florida Department of Revenue or fax it as needed.

Begin filling out your Florida Form Rts 3 online today for a smooth account management experience.

Florida S corporation taxes include federal payroll taxes and federal unemployment tax. Shareholders of Florida S corporations are required to pay federal personal income tax, and some of them might qualify for net investment income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.