Loading

Get Form 14452

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14452 online

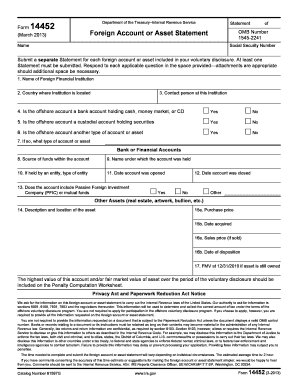

Filling out the Form 14452 is essential for reporting foreign accounts or assets as part of the voluntary disclosure program. This guide provides a step-by-step approach to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the Form 14452 online

- Click the 'Get Form' button to obtain the form and open it in the appropriate editor.

- Begin by filling in your name and Social Security number in the designated fields.

- Next, provide details about your foreign financial institution, including the name and country where it is located.

- Identify a contact person at the institution for any required communication.

- Indicate whether the offshore account is a bank account holding cash, money market, or a certificate of deposit by selecting 'Yes' or 'No'.

- If applicable, specify if the account is a custodial account holding securities.

- Further clarify if the account is another type of account or asset and provide details if necessary.

- Document the source of funds within the account in the specified field.

- Record the name under which the account was held, and if held by an entity, specify the type of entity.

- Input the date the account was opened and closed, if pertinent.

- Provide a description and location of any other assets, if applicable.

- Fill in the purchase price and acquisition date for these assets.

- Report the sales price and date of disposition, if sold, along with the fair market value as of December 31, 2010, if the asset is still owned.

- Make sure to check that all fields are completed accurately, review your information, and make any necessary adjustments.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your Form 14452 online today to ensure compliance with reporting requirements.

For example, interest may be tax-free overseas, but in the U.S., that same income does not qualify as tax-exempt....The main forms that a U.S. taxpayer uses to report foreign interest income, include: 1040 Tax Return. Schedule B. Form 8938.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.