Loading

Get Connectyourcaredependent Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Connectyourcaredependent Form online

This guide provides clear instructions on how to effectively fill out the Connectyourcaredependent Form online. By following these steps, users can ensure a smooth submission process for their dependent care claims.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the Connectyourcaredependent Form and open it in your editor.

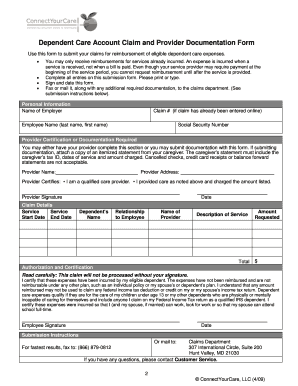

- Begin by entering your personal information in the relevant fields. Be sure to include your employer's name, your claim number (if available), your full name, and your Social Security number.

- Provide necessary provider information. You can either have your care provider fill out this section or attach an itemized statement that contains their tax ID, service dates, and total charges.

- Next, fill in the claim details, including the service start and end dates, your dependent's name, their relationship to you, the provider's name, a description of the service, and the total amount you are requesting.

- Review the authorization and certification section carefully. Confirm that the expenses have been incurred and have not yet been reimbursed. You will need to provide your signature and the date.

- Once you have completed the form, you have the option to save your changes, download the form, print a copy, or share it as needed. Remember to keep a copy for your records before submitting.

Start filling out your Connectyourcaredependent Form online today to ensure prompt processing of your claims.

What Are Qualified Expenses for IRS Form 2441? Qualified expenses include amounts paid for household services and/or the use of a day care center for the qualifying person while you're working or looking for work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.