Loading

Get W2 2014 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

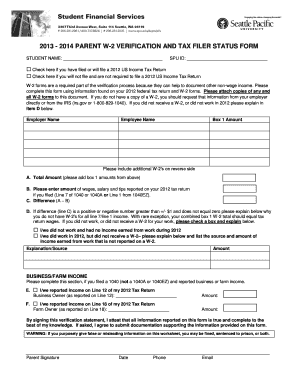

How to fill out the W2 2014 Form online

Filling out the W2 2014 Form online can be a straightforward process when guided properly. This form is essential for reporting your income and tax details accurately.

Follow the steps to accurately complete the W2 2014 Form online.

- Press the ‘Get Form’ button to access the W2 2014 Form and open it for editing.

- Enter your full name in the designated employee name field, ensuring that it matches your tax documents.

- In the employer name field, input the name of your employer as shown on your W-2.

- Locate Box 1 on your W-2, which reports your total wages, tips, and other compensation. Enter this amount in the corresponding field on the form.

- If you filed a 2012 US Income Tax Return, refer to Line 7 of 1040 or 1040A, or Line 1 of 1040EZ for your wages, salary, and tips. Input this amount in the field specified.

- Calculate the difference between the total amount from Box 1 and the amount reported on your tax return. Record this value in the designated difference field.

- If the difference is greater than +/- $1 and does not equal zero, explain the discrepancy in the provided section. You can check the appropriate box if you did not work or did not receive a W-2.

- For users who reported business or farm income, fill out the additional sections as required, providing details from your 2012 tax return.

- Review all entries for accuracy and completeness. Ensure all relevant fields are filled out.

- Finally, you can save your changes, download the completed form, or print it for your records.

Start completing your W2 2014 Form online today for a seamless tax filing experience.

Related links form

The format of the 2022 Form W-2 remains unchanged from the 2021 version. However, to protect sensitive information, the first five digits of the Social Security number will be masked on the mailed copy provided to employees. The mailed copy will include a randomly generated 12-digit Control Number displayed in Box d.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.