Loading

Get Reimbursement Form Non-employee - Johns Hopkins University - Web Jhu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the reimbursement form non-employee - Johns Hopkins University - Web Jhu online

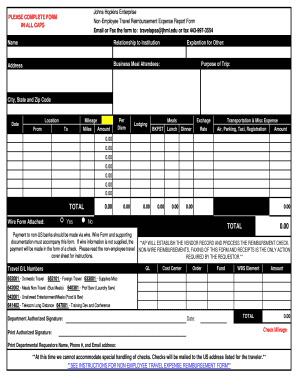

This guide provides clear instructions on how to complete the reimbursement form for non-employees at Johns Hopkins University. By following these detailed steps, users can efficiently fill out the online form, ensuring all necessary information is submitted correctly.

Follow the steps to fill out the reimbursement form successfully.

- Click the ‘Get Form’ button to access the reimbursement form, opening it in your compatible editor.

- Fill in your name at the designated field, using all capital letters as required.

- Indicate your relationship to the institution accurately.

- Provide your complete mailing address, including city, state, and zip code.

- List the attendees of any business meals under 'Business Meal Attendees'.

- Describe the purpose of your trip in the provided section.

- Enter the travel dates, including the departure and return locations.

- Document the mileage for the trip, noting the miles traveled from and to.

- Complete the fields under expenses, detailing amounts for lodging, meals, and other transportation costs.

- For each meal type, enter the relevant amounts for breakfast, lunch, and dinner.

- Fill in the total expenses in the designated section at the bottom of the form.

- If applicable, attach a wire form for payment to non-US banks and include all required supporting documentation.

- Print the name, phone number, and email address of the departmental requester.

- Obtain the department authorized signature and enter the date.

- Once all fields are completed, save changes, and if necessary, download, print, or share the form.

Start completing your reimbursement form online now!

The Johns Hopkins University is a non-profit, educational corporation incorporated in the State of Maryland. The University is responsible for complying with appropriate federal and state corporate tax laws: Generally, the University is exempt under IRS code section 501(c)(3) from federal and state income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.