Loading

Get Co-419 - Apportionment Of Foreign Dividends - Vermont.gov - State Vt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO-419 - Apportionment Of Foreign Dividends - Vermont.gov online

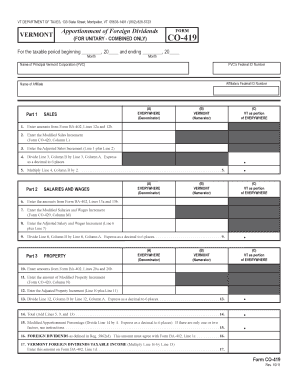

Filling out the CO-419 form is essential for computing the modified apportionment percentage needed to determine the amount of foreign dividends to be included in Vermont taxable income. This guide will help you understand each section of the form and provide clear instructions for completing it online.

Follow the steps to successfully complete the CO-419 form.

- Press the ‘Get Form’ button to access the CO-419 form and open it in your preferred online editor.

- Begin by entering the taxable period's start and end dates in the designated fields. Use the appropriate month format.

- Part 1 requires you to report 'Sales.' Input the amounts from Form BA-402, Lines 12a and 12b in the designated columns for everywhere and Vermont.

- Divide the Vermont amount from the Adjusted Sales Increment by the total from the everywhere amount and express the result as a decimal to six places.

- Proceed to Part 2 for Salaries and Wages. Repeat the process by entering amounts from Form BA-402, Lines 13a and 13b.

- In Part 3, move on to Property. Enter amounts from Form BA-402, Lines 20a and 20b.

- Again, divide the Vermont amount by the everywhere amount as in previous steps and multiply by a factor of your choice.

- Calculate the Modified Apportionment Percentage by dividing the total from the previous step by 4, or a lower number if fewer factors are present.

- Finally, ensure all information is accurate and up to date. Save your changes, download your form, print a copy, or share it as necessary.

Complete your CO-419 form online today to ensure accurate reporting of foreign dividends.

Most foreign stock funds have a credit of about 7% of the dividend. With a yield of about 3%, that would be a $600 dividend and $42 foreign tax credit. For VT, which is only half foreign, the credit would be about 7% of the foreign half, which is $21 on a $20,000 investment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.