Get Administrative Procedural And Miscellaneous Reporting Required Minimum Distributions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Administrative Procedural And Miscellaneous Reporting Required Minimum Distributions Form online

Filling out the Administrative Procedural And Miscellaneous Reporting Required Minimum Distributions Form online can be a straightforward process if you follow the right steps. This guide provides clear instructions to help you navigate each section of the form efficiently.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the form and open it in your browser.

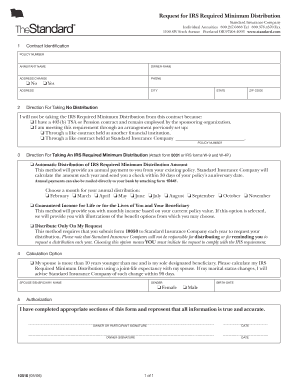

- Begin with the contract identification section. Fill in your policy number, the name of the annuitant, and indicate any address changes. Ensure the owner’s name and contact information are accurate.

- Indicate whether you will take a distribution by selecting the appropriate options. If you choose not to take the IRS required minimum distribution, provide the necessary reasons as directed.

- If you decide to take the distribution, select the method of distribution. You may choose from automatic distribution, guaranteed income for life, or distribution upon request. Follow specific instructions for each option as necessary.

- If applicable, provide the calculation option indicating if your spouse is more than ten years younger and is your sole designated beneficiary.

- Complete the authorization section by signing and dating the form to confirm that all information provided is accurate.

- Review all filled sections for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as needed.

Take the next step in your financial management and fill out the required documents online today!

The RMD correction window refers to the time frame during which you can correct a missed RMD withdrawal without incurring penalties. For instance, if you missed your withdrawal for a particular year, you can remedy this by taking the missed amount and paying applicable taxes. Using the Administrative Procedural And Miscellaneous Reporting Required Minimum Distributions Form will help you keep track of these withdrawals and any corrections needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.