Loading

Get Hardship Evaluation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hardship Evaluation Form online

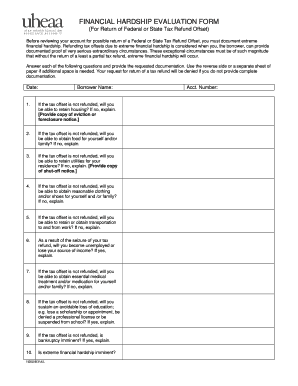

Filling out the Hardship Evaluation Form online is an important step in documenting extreme financial hardship. This guide will provide clear and concise instructions to help you navigate the form effectively.

Follow the steps to fill out the Hardship Evaluation Form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date at the top of the form to indicate when you are submitting your evaluation.

- Provide your name in the 'Borrower Name' field. This should be your full legal name as it appears on your official documents.

- Proceed to answer each question thoroughly. Start with question 1: 'If the tax offset is not refunded, will you be able to retain housing? If no, explain.' Be sure to include any supporting documentation, such as an eviction or foreclosure notice, if applicable.

- Move to question 2: 'If the tax offset is not refunded, will you be able to obtain food for yourself and/or family? If no, explain.' Provide detailed explanations to support your claim.

- Continue with question 3: 'If the tax offset is not refunded, will you be able to retain utilities for your residence? If no, explain.' If applicable, attach a copy of any shut-off notice.

- For question 4, assess whether you will be able to obtain reasonable clothing or shoes. Again, if the answer is no, provide an explanation.

- In question 5, state if you will be able to retain or obtain transportation to work if the tax offset is not refunded. Provide a detailed explanation if the answer is no.

- Question 6 asks whether the seizure of your tax refund will result in unemployment or loss of income. If yes, elaborate on your situation.

- Proceed to question 7 regarding essential medical treatment and/or medication. Be specific about your needs if the answer is no.

- Question 8 focuses on educational losses. If applicable, provide details about the potential impact on your education.

- Question 9 addresses imminent bankruptcy. If this applies to you, provide a clear rationale.

- Finally, question 10 asks if extreme financial hardship is imminent. Provide a concise summary of your circumstances.

- Once all fields are completed, review your answers for completeness and accuracy. Use the reverse side or a separate sheet if additional space is needed.

- Save your changes and consider downloading, printing, or sharing the form as needed to submit your hardship evaluation.

Complete your Hardship Evaluation Form online today to ensure your circumstances are considered.

Extreme hardship is defined by USCIS to mean hardship greater than what a qualifying family member would experience under "normal circumstances" if the undocumented immigrant were not allowed to come to or stay in the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.