Loading

Get South Carolina Form L 2087

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Carolina Form L 2087 online

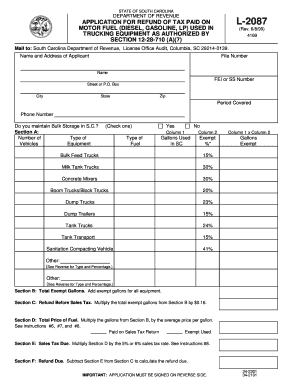

This guide provides clear and comprehensive instructions for filling out the South Carolina Form L 2087 online. Designed for easy understanding, this walkthrough assists users in completing the application for a refund of tax paid on motor fuel used in trucking equipment.

Follow the steps to accurately complete the form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Provide your name and address in the designated fields. Include your file number and either your Federal Employer Identification (FEI) number or Social Security (SS) number.

- Enter the period covered by the refund request and your phone number. Indicate whether you maintain bulk storage in South Carolina by checking the 'Yes' or 'No' box.

- In Section A, list the number and type of vehicles and equipment. Specify the type of fuel used. Fill in the corresponding columns with the gallons used in South Carolina and the exempt percentage based on the listed equipment types.

- Calculate the total exempt gallons in Section B by adding all exempt gallons from Section A.

- In Section C, calculate the refund before sales tax by multiplying the total exempt gallons from Section B by $0.16.

- Proceed to Section D and determine the total price of fuel. Multiply the gallons from Section B by the average price per gallon, ensuring the average price does not include taxes.

- In Section E, calculate sales tax due by multiplying the amount from Section D by the appropriate sales tax rate based on your county's rate (5% or 6%).

- For Section F, subtract the sales tax calculated in Section E from the refund amount in Section C to determine the refund due.

- Lastly, ensure the application is signed on the reverse side. Save the changes, and you can then download, print, or share the completed form as needed.

Complete your documents online today for a smoother filing process.

A JOINT RESOLUTION. TO SUSPEND THE IMPOSITION OF THE USER FEE ON GASOLINE AND DIESEL FUEL AND THE IMPOSITION OF THE ROAD TAX FOR ONE YEAR. Be it enacted by the General Assembly of the State of South Carolina: SECTION 1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.