Loading

Get Rental Surcharge Return St-394 - The South Carolina Department Of ... - Sctax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rental Surcharge Return ST-394 - The South Carolina Department Of Revenue online

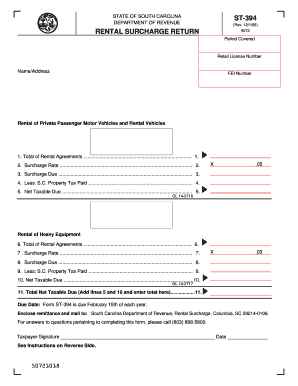

Filling out the Rental Surcharge Return ST-394 is an essential task for rental companies in South Carolina. This guide will provide clear, step-by-step instructions to ensure that users can successfully complete the form online, facilitating compliance with state tax regulations.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- In the 'Period Covered' section, specify the rental period for which you are reporting. This typically spans from January through December of the previous year.

- Enter your retail license number in the designated field, ensuring it is accurate, as this identifies your business.

- Fill in your name and address as the taxpayer, confirming all information is correct for proper processing.

- Input your FEI number, which is necessary for tax identification purposes.

- For the section on private passenger motor vehicles and rental vehicles, enter the total of all rental agreements made during the reporting period in line 1.

- In line 2, select the appropriate surcharge rate for your rentals—5% for private passenger vehicles. Multiply this rate by the total from line 1 to calculate the rental surcharge due, which you will enter in line 3.

- Deduct the total amount of South Carolina property tax paid during the reporting period for these vehicles in line 4.

- Calculate the net taxable due by subtracting line 4 from line 3 and enter the result in line 5. If the result is zero or negative, enter zero.

- Now, repeat a similar process for heavy equipment. Enter the total of rental agreements for heavy equipment in line 6 and apply the 3% surcharge rate in line 7.

- Enter the rental surcharge for heavy equipment in line 8. Deduct any property tax paid on this equipment in line 9.

- Calculate the net taxable due for heavy equipment in line 10 by subtracting line 9 from line 8. As before, if it is zero or negative, enter zero.

- Add the totals from lines 5 and 10 and enter the final amount in line 11. Ensure this is accurate as it represents your total net taxable due.

- Review your entries for any errors, and once satisfied, save the document, and consider downloading or printing it for your records.

Complete your Rental Surcharge Return ST-394 online to ensure timely compliance with South Carolina tax regulations.

Local option taxes are approved by the county through local elections and are imposed in addition to the 6% statewide rate. The rental of accommodations is subject to a 7% statewide rate which is imposed upon the gross proceeds of rentals or charges for any type of sleeping accommodations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.