Loading

Get Pt-455 - The South Carolina Department Of Revenue - Sctax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PT-455 - The South Carolina Department Of Revenue - Sctax online

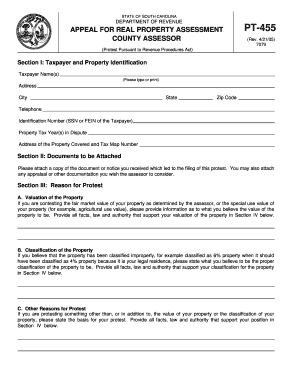

Filing the PT-455 form is an important step in disputing real property assessments within South Carolina. This guide provides a clear and supportive overview of how to complete the form accurately and effectively, ensuring that your protest is submitted correctly.

Follow the steps to complete your PT-455 form accurately.

- Click ‘Get Form’ button to access the PT-455 form and open it in the editing interface.

- Fill in Section I with your taxpayer information. Input the taxpayer name(s), address, city, state, zip code, telephone number, identification number (either SSN or FEIN), the property tax year(s) in dispute, and the address and tax map number of the property involved.

- In Section II, attach the required documents. Include a copy of the notice or document that prompted your protest, as well as any appraisals or additional documentation that support your case.

- Proceed to Section III, where you will explain your reason for protesting. Choose one or more categories: valuation of the property, classification of the property, or other reasons for protest. Clearly state your views and what you believe the property value or classification should be.

- In Section IV, provide detailed information that supports your protest. State all reasons for your disagreement with the assessor, including any relevant facts and legal authority. Feel free to attach additional pages if more space is needed for your explanation.

- Sign the form in the designated spaces provided for both taxpayer and co-owner. Be sure to include the date next to each signature.

- After completing the form, review all entries for accuracy. Once verified, save your changes, download the form for your records, and print or share it as needed.

Complete and file your PT-455 form online to ensure your property assessment protest is processed timely.

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.