Loading

Get Sc Form 1 309

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sc Form 1 309 online

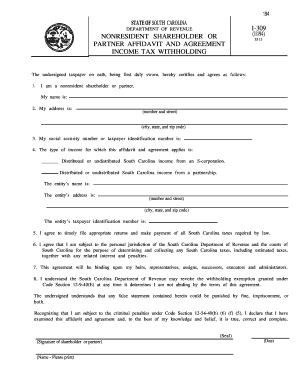

The Sc Form 1 309 is a critical document for nonresident shareholders or partners in South Carolina, allowing for the exemption from certain income tax withholdings. This guide provides clear, step-by-step instructions on how to complete the form online to ensure compliance with state tax regulations.

Follow the steps to complete the Sc Form 1 309 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- In the first section, provide your name as the nonresident shareholder or partner. This is critical for identification.

- Enter your address including the number and street, city, state, and zip code. Ensure that all information is accurate.

- Input your social security number or taxpayer identification number in the designated area, which is necessary for taxation purposes.

- Specify the type of income applicable to this affidavit by checking the appropriate box related to either distribution from an S-corporation or partnership.

- Document the name and address of the entity from which you are receiving income, as well as the entity’s taxpayer identification number.

- Affirm your agreement to file the necessary tax returns and make all required payments to South Carolina taxes. Review this section carefully.

- Acknowledge that you are subject to the jurisdiction of the South Carolina Department of Revenue, including all related laws and penalties if compliance is not maintained.

- Sign the document, ensuring to print your name accordingly underneath your signature.

- Finally, add the date of signing. After reviewing all entries for accuracy, save changes to the form. You may now download, print, or share the completed document as needed.

Complete your Sc Form 1 309 online to ensure timely tax compliance.

Related links form

A Michigan Composite Individual Income Tax Return (Form 807) is a collective individual income tax filing for two or more participating nonresident members filed by the flow-through entity (FTE). This form is used to report and pay individual income tax under Part 1 of Public Act 281 of 1967, as amended.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.