Loading

Get Form T-71a - Rhode Island Division Of Taxation - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form T-71A - Rhode Island Division of Taxation - Tax Ri online

Navigating the Form T-71A from the Rhode Island Division of Taxation can be straightforward with the right guidance. This guide provides a comprehensive, step-by-step approach to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your name, address, city, state, and ZIP code in the designated fields at the top of the form. Ensure the information is current and accurate.

- Provide your Federal Employer Identification Number or Social Security Number along with your email address. This information is crucial for identification and correspondence.

- Indicate the state or country of incorporation or organization. This section helps to identify the legal framework under which you operate.

- Enter your broker license number in the respective field to confirm that you are authorized to conduct surplus line business.

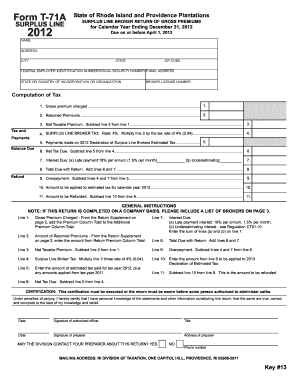

- In the computation of tax section, list the gross premium charged from your business operations in line 1. This figure should include all premiums collected.

- For line 2, report the amount of returned premiums. This is the total of all refunds made to clients.

- Calculate the net taxable premium by subtracting the amount in line 2 from line 1 and enter the result in line 3.

- To compute the surplus line broker tax, multiply the net taxable premium in line 3 by the tax rate of 4%. Write the result in line 4.

- Indicate any payments made on the 2012 declaration of surplus line brokers estimated tax in line 5.

- For line 6, calculate any balance due and proceed to line 7 to determine the interest, if applicable, based on late payments or underestimating premiums.

- Add lines 6 and 7 to determine the total due with your return, placing this sum in line 8.

- In line 9, report any overpayment by subtracting lines 4 and 7 from line 5.

- Calculate the net tax due in line 6 by subtracting line 5 from line 4.

- Indicate the amount to be applied to estimated tax for calendar year 2013 in line 10.

- Finally, subtract line 10 from line 9 to determine the amount to be refunded, and place this figure in line 11.

- Review all entered information carefully before certification. Ensure that all required signatures are in place.

- Once completed, save your changes, download, print, or share the form as necessary.

Complete your documents online to ensure timely and accurate submission.

Related links form

Rhode Island is not tax-friendly toward retirees. Social Security income is partially taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 3.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.