Get Application For Ad Valorem Tax Exemption For Charitable And Non Profit Entities - Tax Ok

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Ad Valorem Tax Exemption For Charitable And Non Profit Entities - Tax Ok online

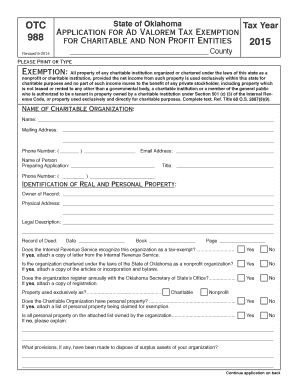

Filling out the Application For Ad Valorem Tax Exemption for Charitable and Non Profit Entities can seem daunting, but with this structured guide, you can navigate the process with confidence. This application is essential for organizations seeking a tax exemption in the state of Oklahoma, and accurately completing it is key to ensuring your submission is successful.

Follow the steps to accurately complete your tax exemption application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the information for the Name of Charitable Organization, including the mailing address, phone number, and email address. It is crucial to provide accurate and complete information as it will be used for all official communications.

- Indicate the name and contact information of the person preparing the application, including their title and phone number.

- Identify the Real and Personal Property by providing the owner of record, physical address, and a legal description of the property.

- Complete the Record of Deed section by filling in the date, book, and page number related to the ownership record.

- Respond to the questions regarding the Internal Revenue Service recognition, Oklahoma nonprofit chartering, and annual registration with the Oklahoma Secretary of State, attaching necessary documentation as specified.

- If applicable, indicate whether your organization owns personal property and attach a detailed list of this property being claimed for exemption.

- In the Property Usage section, provide written explanations for each question regarding property usage, income usage, and operational practices, clearly articulating how your organization serves its patrons.

- Compile and attach supporting documents that substantiate your application. This includes incorporation articles, bylaws, IRS Section 501(c)(3) status, and any additional relevant documentation.

- Finally, complete the affidavit section by signing and dating the application, ensuring that all information provided is accurate and complete.

- After completing the entire form, you can save changes, download, print, or share the application as needed.

Take the first step towards obtaining your tax exemption by completing the application online today.

How many acres must I farm to be considered eligible for the Exemption Permit? If the land is being actively farmed, there is no restriction on the number of acres that you are farming. When will my permit expire? The Agricultural Exemption Permits are good for three (3) years from the date of issue.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.