Get Forms W-2/k-2 - Kentucky: Department Of Revenue - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms W-2/K-2 - Kentucky: Department Of Revenue - Revenue Ky online

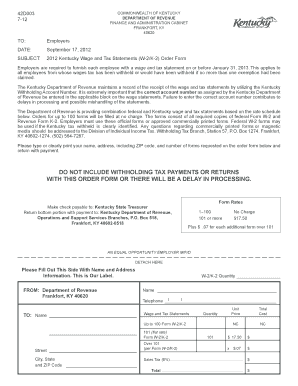

Filling out the Forms W-2 and K-2 is an essential task for employers in Kentucky. This guide will provide a clear and supportive overview of how to complete these forms online, ensuring that you understand each component required for compliance.

Follow the steps to fill out the Forms W-2/K-2 effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your Kentucky Withholding Account Number in the designated block. Ensuring this number is correct is critical to avoid delays in processing your wage and tax statements.

- Fill in the employee's details such as name, address, and social security number clearly. Accuracy in these fields helps prevent issues when filing.

- Input the total wages paid and the amount of Kentucky tax withheld for each employee in the appropriate fields. Be diligent to ensure these amounts are correct to maintain compliance with tax regulations.

- Once all relevant fields are completed, review your entries for accuracy. This step minimizes errors that can lead to penalties or further inquiries.

- After verification, you can save your changes, download the completed forms, and prepare them for printing or sharing as needed.

Start completing your Forms W-2/K-2 online today to ensure timely filing!

To obtain a Kentucky W-2, you should first contact your employer, as they are responsible for providing this form by January 31st each year. If you have not received your W-2, follow up with your payroll department. In case you are unable to retrieve it, you can file a form with the Kentucky Department of Revenue for assistance. For a seamless experience, consider using uslegalforms, which can guide you through the process related to Forms W-2/K-2 - Kentucky: Department Of Revenue - Revenue Ky.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.