Get 40a201np Wh Sl 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 40a201np Wh Sl 2019 online

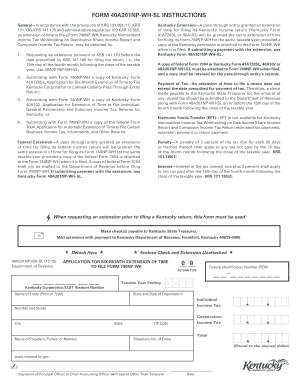

Filling out the 40a201np Wh Sl 2019 form online can be a straightforward process if you understand each section and field. This guide will walk you through the necessary steps, ensuring you can complete your Kentucky nonresident income tax withholding application accurately and efficiently.

Follow the steps to successfully complete the 40a201np Wh Sl 2019 form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Indicate the taxable year ending by entering the month and year in the designated fields. Ensure all dates are accurate to avoid processing delays.

- Enter the Kentucky Corporation/LLET account number in the appropriate field. This number is crucial for identification purposes.

- Provide the name of the entity clearly in the 'Name of Entity' section. Ensure that you use print or type for legibility.

- Complete the 'Name of President, Partner, or Member' section with the appropriate individual responsible for the entity, ensuring their name is entered correctly.

- Fill in the 'State and Date of Organization' to provide details on where and when the entity was established.

- Provide the complete street address, including number, street name, city, and ZIP code to ensure correct delivery of any correspondence.

- Enter the Federal Identification Number (FEIN) which is essential for tax processing purposes.

- Select the type of return you are filing, whether Individual Income Tax or Corporation Income Tax, as indicated on the form.

- Insert the total amount of tax due, rounding to the nearest dollar in the specified box.

- Enter the telephone number of the entity in the corresponding field for potential follow-up.

- Ensure that the signature of the principal officer or chief accounting officer is included, along with the date of signing to validate the submission.

- Once all fields are accurately filled, you can save changes, download, print, or share the completed form as needed.

Start completing your 40a201np Wh Sl 2019 form online today and ensure timely submission.

The number for non-resident withholding in Kentucky is typically referred to as the withholding tax rate, which may vary based on specific income brackets. As a non-resident, you need to know this rate to accurately calculate your withholding tax obligations. For your reference, the 40a201np Wh Sl 2019 can provide detailed information about withholding requirements. If you find the process overwhelming, platforms like US Legal Forms can assist you in understanding your non-resident tax responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.