Loading

Get Delaware 400 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware 400 online

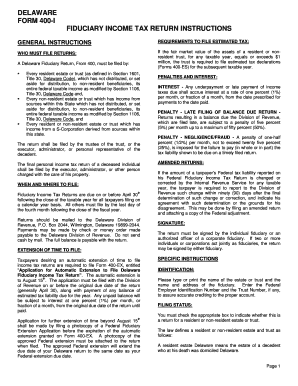

The Delaware 400 is a fiduciary income tax return that must be filed by specific estates and trusts in Delaware. This guide provides a clear and comprehensive approach to completing the form online, ensuring that you understand each component and requirement.

Follow the steps to fill out the Delaware 400 online

- Press the ‘Get Form’ button to access the Delaware 400 online and open it in your preferred editor.

- Begin by providing your identification information. This includes the name of the estate or trust, the fiduciary's name and address, and the federal employer identification number. Ensure that all information is accurate to avoid issues with crediting.

- Indicate your filing status by checking the appropriate box for either a resident or non-resident estate or trust. Familiarize yourself with the definitions to ensure correct categorization.

- Complete Schedule A for Delaware modifications and additions. This includes entering interest from obligations of states other than Delaware, state income taxes deducted on the federal return, and any other relevant adjustments.

- Proceed to Schedule B to allocate Delaware modifications among beneficiaries and the fiduciary. Record the shares of federal distributable net income and apply the correct percentages to ensure accuracy.

- Fill out Schedule C for non-resident beneficiaries. Provide details on income accumulated and any deductions applicable to non-resident beneficiaries.

- Calculate the tax due based on the forms and schedules completed. Use the tax rate schedule provided within the form for accurate computations.

- Review all completed fields for errors or omissions. Ensure all required signatures are included. The return must be signed by the fiduciary or an authorized officer.

- Once all information is accurate and complete, save your changes, and proceed to download or print the form for submission.

- Finally, if applicable, submit any required payments along with your return to the Delaware Division of Revenue at the specified address.

Start filling out the Delaware 400 online today to ensure accurate and timely filing.

In Delaware, the amount you need to earn to file taxes is based on your filing status and age. Each tax year, the state sets these figures which help determine your filing requirements. If you're unsure about your obligations, consulting the Delaware 400 resources or using uslegalforms can provide clarity and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.