Loading

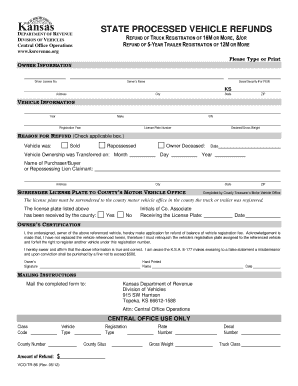

Get Kansas State Processed Vehcicle Refunds. Tr-86 - State Processed Vehcicle Refunds 16m 5-year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KANSAS State Processed Vehicle Refunds TR-86 - State Processed Vehicle Refunds 16M 5-YEAR online

Filing for a vehicle refund can seem daunting, but this guide will help you navigate the KANSAS State Processed Vehicle Refunds form TR-86 with ease. Follow these detailed steps to ensure your application is filled out correctly and submitted without hassle.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to acquire the form and access it in the online editor.

- Begin with the owner information section. Enter your driver license number, full name, social security number or FEIN, and complete your address details including city, state, and ZIP code.

- Next, proceed to the vehicle information section. Fill in the vehicle's year, make, VIN, registration year, license plate number, and declared/gross weight.

- In the reason for refund section, check the applicable box to indicate if the vehicle was sold, repossessed, or if ownership was transferred. If the owner is deceased, enter the relevant dates.

- Provide the name and address of the purchaser or repossessing lien claimant if applicable.

- Indicate whether the license plate has been surrendered to the county's motor vehicle office. This is a necessary step to complete your refund request.

- Complete the owner’s certification section. Here, you need to affirm the accuracy of the provided information, sign the form, and write your hand-printed name along with the date.

- Finally, save the changes you made to the form, and prepare to download, print or share the completed document as needed before mailing it to the appropriate address for submission.

Complete your forms online today to ensure a smooth and successful refund process.

Related links form

The statute of limitations for claiming a sales tax refund in Kansas is generally three years from the date of the overpayment. It is crucial to file your claim within this time frame to avoid losing your right to a refund. If you are dealing with KANSAS State Processed Vehicle Refunds TR-86, be mindful of this limitation to ensure you receive what you are owed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.