Get Boe 241a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the BoE 241a Form online

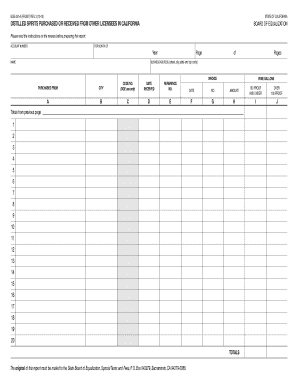

Filling out the BoE 241a Form online is a straightforward process designed to report distilled spirits purchased or received from other licensees in California. This guide will provide you with clear, step-by-step instructions to ensure accurate completion of the form.

Follow the steps to successfully complete the BoE 241a Form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your account number in the designated field, ensuring that it is accurate to avoid processing issues.

- Specify the reporting month and year at the top of the form, as this is essential for your accurate filing.

- Indicate the page number and total number of pages you are submitting for this reporting period.

- Enter the owner or company name accurately as it appears in your business records.

- Fill in the business address, including street, city, state, and ZIP code for proper identification.

- In Column A, input the name of the California seller from whom the distilled spirits were purchased.

- Complete Column B by entering the city in California where the seller's business is located.

- Column C is reserved for Board of Equalization use; do not enter any information in this column.

- In Column D, document the date when the shipment was received.

- Column E requires you to enter the purchase order number, release number, or any reference number related to your purchase.

- Provide the invoice date for the shipment in Column F.

- Record the invoice number that corresponds to the shipment in Column G.

- In Column H, fill in the total dollar amount of the invoice you received.

- Enter the total gallons of distilled spirits that are 100 proof or under in Column I, as specified on the seller's invoice.

- Complete Column J with the total gallons of distilled spirits that are over 100 proof according to the seller's invoice.

- Ensure you add the totals from Columns I and J and record them in the totals boxes at the bottom of the report.

- Once all fields are accurately filled out, review the information for any errors.

- You may then save any changes made to the form.

- Finally, proceed to download, print, or share the completed form as needed.

Take the first step towards effective distilled spirits reporting by filling out the BoE 241a Form online today.

In California, the excise tax on spirits is set at $3.30 per gallon. This tax applies to all distilled spirits sold within the state, impacting both consumers and businesses in the alcohol industry. If you are involved in the sale of spirits, understanding this tax is crucial for compliance. To manage your tax obligations effectively, consider utilizing the Boe 241a Form, which can be accessed through platforms like US Legal Forms, ensuring you stay informed and compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.