Get California Tire Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Tire Fee Return online

Filling out the California Tire Fee Return online is a straightforward process that requires attention to detail. This guide provides comprehensive, step-by-step instructions to help you accurately complete the form and fulfill your filing responsibilities.

Follow the steps to complete your return with ease

- Press the ‘Get Form’ button to access the California Tire Fee Return form and open it in your online editor.

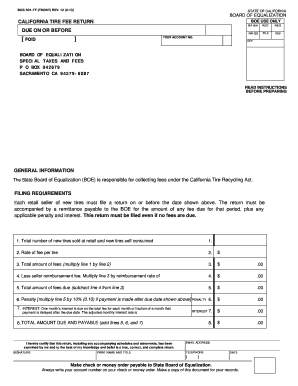

- Locate the section for 'General Information.' Review the instructions laid out by the State Board of Equalization to understand the filing requirements and fee obligations.

- In the field labeled 'Total number of new tires sold at retail and new tires self consumed,' enter the total quantity of new tires you sold and those you consumed yourself.

- In the 'Rate of fee per tire' field, input the current fee amount applicable per tire.

- Calculate the total amount of fees by multiplying the value from step 3 by the amount in step 4. Enter this total in the corresponding field.

- For the 'Less seller reimbursement fee' section, multiply the total fee amount from step 5 by 1.5% (0.015) and input this value.

- Subtract the value from step 6 from the total amount of fees in step 5. Enter the resulting total amount of fees due.

- If your payment is made after the due date, calculate a penalty by multiplying the total amount from step 7 by 10% (0.10) and include this in the designated field.

- If applicable, calculate interest based on the total fee for each month it's delayed, and add this to the form.

- Finally, sum the values of the total amount of fees due, penalty, and interest to arrive at the 'Total amount due and payable.'

- Review all entered information for accuracy, and save your changes. You can then download, print, or share the completed form as necessary.

Complete your California Tire Fee Return online today to ensure compliance and timely filing.

Related links form

To file the California Tire Fee Return for the CDTFA environmental fee, you need to visit the California Department of Tax and Fee Administration's website. There, you can access the necessary forms and guidelines for submitting your fee return. Make sure to gather all required documentation, such as sales receipts and payment records. If you need assistance, consider using US Legal Forms for a streamlined filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.