Loading

Get Section 2602372d Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 2602372d Form online

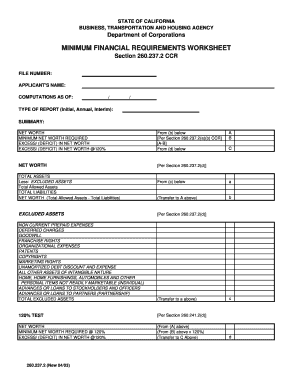

Filling out the Section 2602372d Form is an essential step for ensuring compliance with financial reporting requirements. This guide will assist you in completing the form accurately and efficiently, helping you navigate each section with ease.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to access the form and open it in the designated online editing tool.

- Enter the file number in the appropriate field. This information is necessary for tracking and referencing your submission.

- Input the applicant's name accurately. This should reflect the legal name of the entity or individual filling out the form.

- Select the type of report you are submitting - Initial, Annual, or Interim. Ensure that this choice aligns with your reporting period.

- In the summary section, fill in the net worth, minimum net worth required, and the calculations for excess or deficit in net worth. Refer to the guidelines in Section 260.237.2 for accurate data input.

- Calculate and document the total assets and excluded assets meticulously. For total allowed assets, subtract excluded assets from total assets.

- Fill out total liabilities and calculate net worth by subtracting total liabilities from total allowed assets.

- Provide details for excluded assets, specifying each asset type that does not count towards net worth, as outlined in Section 260.237.2(d).

- Complete the 120% test section by entering the net worth, minimum net worth required multiplied by 120%, and calculating excess or deficit.

- Review all entered information for accuracy. Once confirmed, you can save your changes, download a copy of the form, print it, or share it as needed.

Complete your document online today for seamless processing.

A property may be disqualified from Section 1237 capital gain treatment if it was primarily used for personal purposes before subdivision. Additionally, if the property is not held for investment or if it does not meet the holding period requirement, you may lose eligibility for this treatment. Consulting resources like the Section 2602372d Form can clarify your position and ensure compliance with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.