Get Sr 9 Federal Revenue Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sr 9 Federal Revenue Certification Form online

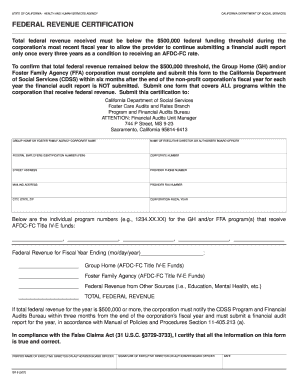

The Sr 9 Federal Revenue Certification Form is essential for confirming that a corporation's total federal revenue remains below the $500,000 threshold in order to maintain submission guidelines for financial audit reports. This guide provides step-by-step instructions on how to fill out this form online.

Follow the steps to complete the Sr 9 Federal Revenue Certification Form online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by filling out the corporate name of the group home or foster family agency at the top of the form.

- Provide the name of the executive director or authorized board officer in the designated field.

- Enter the federal employer identification number (FEIN) to identify the corporation's tax status.

- Fill in the corporate number for your organization as per your official documentation.

- Input the street address, provider phone number, mailing address, and provider fax number for communication purposes.

- Record the city, state, and ZIP code corresponding to the corporate address.

- Indicate the corporation's fiscal year clearly, ensuring it aligns with your financial records.

- List the individual program numbers that receive AFDC-FC Title IV-E funds in the provided fields.

- Document the federal revenue for the fiscal year ending (month/day/year) in the appropriate section.

- Complete the revenue sections for Group Home AFDC-FC Title IV-E Funds and Foster Family Agency AFDC-FC Title IV-E Funds.

- Report any federal revenue from other sources, such as education or mental health.

- Calculate the total federal revenue and ensure it is clearly marked.

- If the total federal revenue is $500,000 or more, note the requirement to notify the California Department of Social Services within three months.

- Certify that all information provided is true and correct by printing the name of the executive director or authorized board officer.

- Sign and date the form, ensuring all fields are filled out accurately.

- Once completed, save your changes, and prepare to download, print, or share the form as needed.

Complete your Sr 9 Federal Revenue Certification Form online today to ensure compliance and maintain funding eligibility.

Filing a W-9 form is straightforward; you simply complete the form and provide it to the requester. Unlike other tax forms, you do not send the W-9 to the IRS. If you need to manage various forms easily, consider using the uslegalforms platform, which simplifies the process of obtaining and storing the Sr 9 Federal Revenue Certification Form alongside other necessary documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.