Get Form S Dc S N

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form S Dc S N online

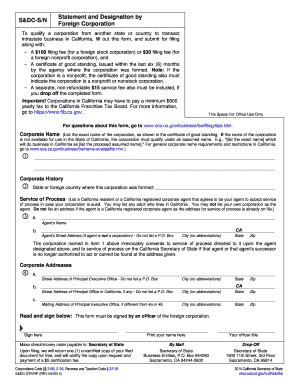

Filling out the Form S Dc S N is an important step for foreign corporations seeking to conduct business in California. This guide provides clear and comprehensive instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Form S Dc S N online

- Click ‘Get Form’ button to access the form online and open it in your preferred editor.

- Enter the exact corporate name as stated on the certificate of good standing. If the name is unavailable in California, include the proposed assumed name.

- Provide the state or foreign country where the corporation was originally formed.

- Designate a California resident or registered corporate agent for service of process. Include the agent's name and a physical address (no P.O. Boxes) for the designated agent.

- Fill in the street address of the principal executive office and the principal office in California if applicable. Avoid using P.O. Boxes.

- Complete the mailing address of the principal executive office if it differs from the previous addresses.

- An authorized officer of the foreign corporation must sign the form here. Ensure to print their name and title clearly.

- Make sure to include the required filing fees: $100 for foreign stock corporations or $30 for foreign nonprofit corporations, along with a $15 service fee if submitting in person.

- Once completed, save changes, download, print, or share the form as needed before submission.

Start filling out the Form S Dc S N online today!

In California, a Statement of Information is essential for businesses to maintain their good standing. This document typically includes key information such as the business name, address, and the names and addresses of the officers and directors. Additionally, it must be filed annually or biennially, depending on your business type. To streamline this process, you can use the Form S Dc S N available on the US Legal Forms platform, which provides a clear and easy way to fulfill these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.