Loading

Get 2012 Ar1100ct Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ar1100ct Form online

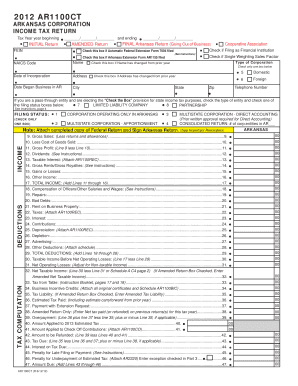

This guide provides a step-by-step approach to filling out the 2012 Ar1100ct Form online, ensuring you can complete your Arkansas Corporation Income Tax Return efficiently and accurately. Follow the instructions carefully to navigate each section of the form.

Follow the steps to complete the 2012 Ar1100ct Form online

- Click ‘Get Form’ button to access the form and launch it in the editor.

- Begin by filling out the initial section, including the tax year, checking the correct initial or amended return box, and providing your Federal Employer Identification Number (FEIN). Ensure that you also check if the Arkansas Extension Form AR1155 has been filed.

- In the business information section, enter your name, NAICS code, and indicate if you are filing as a cooperative association or financial institution. Make sure to select the type of corporation and the relevant boxes for changes in the name or address from the prior year.

- Input the date of incorporation, date you began business in Arkansas, and your address, including city, state, and zip code. Include a telephone number for contact purposes.

- If you are a pass-through entity, indicate your entity type and select the appropriate filing status. Remember to check only one box corresponding to your corporation's operational area (domestic or foreign) as instructed.

- Proceed to the income section. Fill in the gross sales, cost of goods sold, and other income line items as they pertain to your operations. Each line requires precise input reflecting your financial data.

- For deductions, accurately report all eligible expenses, such as compensation for officers, bad debts, and taxes. Each type of deduction should be supported with relevant documentation as specified.

- Calculate your total income and total deductions. Subtract the total deductions from total income to determine your taxable income.

- Complete the tax computation section, including business incentive credits and tax liability calculations. Follow the instructions for amounts due, overpayments, and refunds carefully.

- Once you have filled out all sections, review the document for accuracy. After ensuring the form is complete, you can save changes, download, print, or share the completed document.

Start filling out your 2012 Ar1100ct Form online today for a smooth filing experience.

Filing a corporate tax return in the UAE typically involves preparing financial statements and submitting them to the relevant authority. While this topic differs from the 2012 Ar1100ct Form, understanding corporate tax obligations is essential for businesses operating in the UAE. Consider consulting with a local tax professional or using dedicated platforms for more tailored guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.