Loading

Get How To Fill Out Mw507 2020 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Out Mw507 2020 online

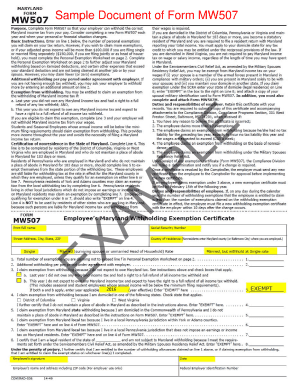

This guide provides detailed, step-by-step instructions on how to effectively complete the Mw507 2020 form online. Whether you are familiar with digital document management or this is your first experience, the following information will assist you in navigating the form with ease.

Follow the steps to complete your Mw507 2020 form online.

- Click the ‘Get Form’ button to obtain the Mw507 2020 form and open it in your preferred online editor.

- Read the instructions provided on the form carefully, as they contain vital information that will help you accurately complete the form.

- Fill in your personal information in the designated fields, including your name, address, and Social Security number.

- Indicate your filing status and the number of withholding exemptions you are claiming, based on your financial situation.

- Provide details about any additional withholding, if applicable. Ensure you include any relevant amounts that apply to your tax situation.

- Review any exemption qualifications and check the corresponding boxes if you qualify for tax exemption under the stated criteria.

- Make sure all information is complete and accurate. Double-check for any errors or omissions before proceeding.

- Once you have filled out the form, you can save your changes, download a copy, print it for your records, or share the form as needed.

Complete your Mw507 2020 form online today for a smooth tax withholding process.

Claiming exemption means that you are choosing not to have any state tax withheld from your paycheck based on your current tax situation. This is typically advisable for individuals who do not expect to owe taxes at the end of the fiscal year. Understanding what it means to claim exemption is crucial as part of knowing how to fill out MW507 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.