Loading

Get Al 20c Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL 20C Instructions online

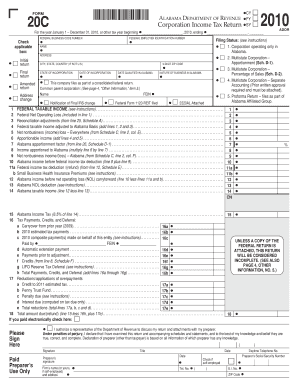

Filling out the AL 20C, the Alabama Corporation Income Tax Return, can seem daunting. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete your AL 20C Instructions online

- Press the ‘Get Form’ button to access the AL 20C Instructions form. This will allow you to open the document in your preferred online editor.

- Begin by entering the tax year in the designated field, specifying the year your taxes cover, typically from January 1 to December 31, or the other dates as applicable.

- Fill in the corporate name and address fields accurately. Make sure to include the city, state, and zip code.

- Provide information regarding the nature of business in Alabama and the state of incorporation, alongside the incorporation date.

- Follow the instructions for reporting federal taxable income and net operating loss. Make any necessary reconciliation adjustments as specified in the guidelines.

- At the end of the process, utilize the options available to save changes, download, print, or share the completed form.

Get started on your AL 20C Instructions form online today to ensure timely and accurate submission.

Many find Schedule C manageable, especially with the right resources. While it requires attention to detail, the process can be straightforward with proper preparation. By following the Al 20c Instructions, you can simplify the filling process and minimize potential errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.