Loading

Get Occupational Tax Net Profits Reporting Form - Scenic Mccreary ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Occupational Tax Net Profits Reporting Form - Scenic McCreary online

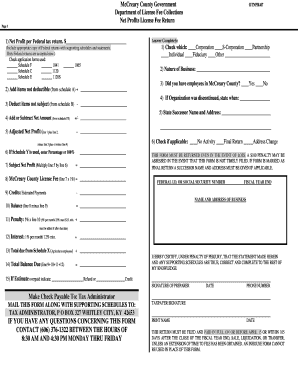

Filling out the Occupational Tax Net Profits Reporting Form for Scenic McCreary is essential for compliance with local tax regulations. This guide provides a step-by-step approach, ensuring that users can complete the form accurately and efficiently online.

Follow the steps to successfully fill out the form online.

- Press the ‘Get Form’ button to access the Occupational Tax Net Profits Reporting Form and open it in the online editor.

- Start with line 1 by entering the net profit amount as reported on your federal tax return. Ensure to include a copy of your Federal returns with supporting schedules.

- In line 2, add any items that are not deductible according to Schedule A. Make sure to transfer the total to this line.

- In line 3, subtract items that are not subject to the tax from Schedule B.

- Line 4 entails adding or subtracting the net amount from Schedule PS as applicable.

- Calculate the adjusted net profit in line 5 by adding the amounts from line 1 and line 2, or adjusting based on lines 3 and 4.

- In line 6, apply the percentage from Schedule Y if necessary, and enter it into the form.

- Line 7 requires you to multiply the adjusted net profit from line 5 by the percentage from line 6. This will give you the subject net profit.

- On line 8, calculate the McCreary County license fee by multiplying the amount in line 7 by 1%.

- Enter any credits from estimated payments in line 9.

- Line 10 is where you calculate the balance due by subtracting the amount in line 9 from line 8.

- For lines 11 and 12, calculate penalties and interest if necessary, as specified in the instructions.

- Line 13 involves entering any additional totals due related to Schedule X.

- Finally, provide the total balance due in line 14 by summing the amounts from lines 9, 10, 11, and 12.

- If the estimate was overpaid, indicate whether you would like a refund or a credit.

- Review the completed form for any errors, then save changes and choose to download, print, or share the form as needed.

Complete your Occupational Tax Net Profits Reporting Form online today to ensure compliance and avoid penalties.

Occupational Tax The occupational license tax rate is 1.85%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.