Loading

Get Schedule Cc Request For A Closing Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Cc Request For A Closing Form online

This guide provides a clear, step-by-step process for completing the Schedule Cc Request For A Closing Form online. Designed for users with varying levels of legal experience, this resource aims to facilitate understanding and efficient submission of this important document.

Follow the steps to successfully complete your form online.

- Press the 'Get Form' button to access the Schedule Cc Request For A Closing Form and open it in your online document editor.

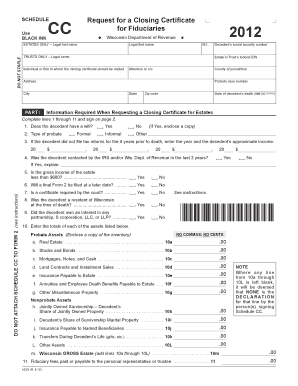

- Begin filling out the top section of the form. Include the legal last name and first name of the decedent, their middle initial, and their social security number. If applicable, enter the legal name of the trust and its federal Employer Identification Number (EIN).

- Identify the individual or firm who should receive the closing certificate. Provide any relevant attention or care of (c/o) information along with the county of jurisdiction.

- Input the address including city, state, and zip code of the recipient. Do not forget to enter the probate case number.

- Record the date of the decedent’s death in the specified format (MM DD YYYY).

- Complete Part I by answering questions 1 through 11. This includes confirming whether the decedent had a will, the type of probate, and details about the decedent's tax history, gross income, and the estate's assets.

- If applicable, provide information about any trusts under Part II, following similar steps to disclose relevant details and asset values as specified.

- Once all necessary information has been filled in, review your entries for accuracy and ensure all required fields are completed.

- Finalize the form by signing and dating it. If someone other than the signer prepared the form, include their name, signature, date, and daytime phone number.

- After reviewing the form for completeness, save your changes. You can then download, print, or share the completed Schedule Cc Request For A Closing Form as needed.

Start filling out your documents online today for a streamlined process.

You can request an estate tax closing letter once the estate tax return has been filed and all tax liabilities are settled. Typically, this is after the IRS has processed the estate tax return. Using your Schedule Cc Request For A Closing Form expedites the process for obtaining this important document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.