Loading

Get Form 8583

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8583 online

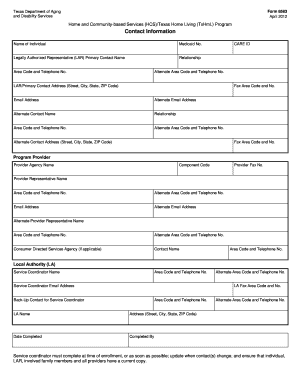

Filling out Form 8583 is an essential step in the Home and Community-based Services (HCS) and Texas Home Living (TxHmL) programs. This guide will provide you with detailed, step-by-step instructions for successfully completing the form online.

Follow the steps to effectively complete Form 8583.

- Press the ‘Get Form’ button to retrieve the form and open it in the designated document editor.

- Begin by entering the name of the individual receiving services and their Medicaid number. This information is crucial for identification purposes.

- Next, provide the Legally Authorized Representative (LAR) primary contact's name, relationship to the individual, and their contact information, including area code and telephone number.

- Fill in the CARE ID, and both primary and alternate email addresses for the LAR or primary contact to ensure communication is maintained.

- Continue by listing an alternate contact name, their relationship, and their corresponding contact information.

- On the following section, complete the details of the program provider. This includes the provider agency name, component code, provider fax number, and contact information for the provider representative.

- If applicable, include the details for the Consumer Directed Services agency, including the contact name and phone number.

- Move on to the Local Authority (LA) section. Here, fill out the service coordinator's name, contact details, and email address.

- Lastly, make sure to indicate the date the form was completed and who completed it, providing their alternate contact number if necessary.

- Once all sections are filled out, you can save your changes, download the completed form, print it for your records, or share it as needed.

Complete the Form 8583 online today to ensure proper enrollment in the necessary services.

Yes, you must report any income even if you donated it all to charity. The IRS requires you to report your total income, but you can claim deductions for your charitable contributions. This process can become complex, especially when considering your tax liability. Using uslegalforms can help you manage your reporting and ensure you capture all eligible deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.