Loading

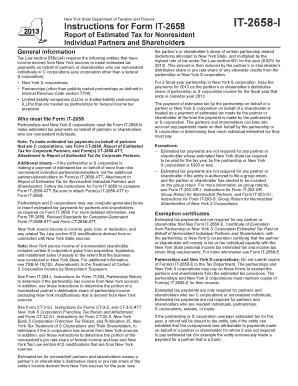

Get Is It 2658 E For 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Is It 2658 E For 2013 Form online

Filling out the Is It 2658 E For 2013 Form can be a straightforward process when approached systematically. This guide will provide you with comprehensive, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to retrieve the form and access it for filling out online.

- Indicate the date for which the estimated tax payments are being made by marking an X in the appropriate box provided in the form.

- Enter the partnership’s or New York S corporation’s legal name, any business name if different, their address, and employer identification number (EIN). Include a contact name and phone number for further assistance.

- Input the total number of nonresident individual partners or shareholders for whom estimated tax payments are being made. This number should correspond to the figures on the attached forms if applicable.

- Provide the total New York source income of the entity and the total estimated tax paid on behalf of the nonresident partners or shareholders.

- For each nonresident partner or shareholder, enter their name, address, and percentage of ownership within the partnership or S corporation. Ensure to round the ownership percentage to four decimal places.

- Record each individual partner’s or shareholder's social security number (SSN) accurately.

- Calculate and enter the amount of estimated tax paid on behalf of each nonresident partner or shareholder using the guidelines provided in the form, using either current or prior-year amounts as needed.

- Review all entries for accuracy before proceeding. Changes can often be saved within the platform, making it easy to correct any mistakes before finalizing.

- Upon completion, you can download, print, or share the form as needed. Ensure to keep a copy for your records.

Start completing the Is It 2658 E For 2013 Form online today for timely submissions.

Deciding whether to claim an exemption depends on your individual tax circumstances. Claiming an exemption might be advantageous if you expect no tax liability, allowing you to keep more of your earnings throughout the year. Conversely, if you prefer to avoid owing taxes at year-end, it may be wiser not to claim an exemption. Consider consulting uslegalforms for tailored advice regarding 'Is It 2658 E For 2013 Form.'

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.