Get It 112 R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 112 R online

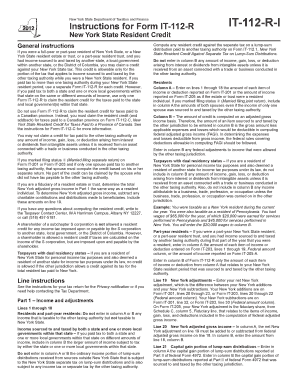

The It 112 R form allows New York State residents to claim a credit for income taxes paid to other states or local governments. This guide offers a clear, step-by-step approach to filling out the form online, ensuring users understand each section and field.

Follow the steps to successfully complete the It 112 R online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin with Part 1, where you will enter your income and adjustments. Follow the instructions carefully to avoid omitting any income that is taxable to the other taxing authority but not to New York State.

- Complete lines 1 through 18 by entering the appropriate amounts in columns A and B, ensuring you include only the taxable amounts relevant to your situation.

- On line 19, report your New York adjustments, which are the net difference between your New York additions and subtractions.

- Proceed to line 20 to calculate and enter your New York adjusted gross income based on your federal adjusted gross income.

- Continue to line 23 to indicate the two-letter state abbreviation for the jurisdiction where you paid income tax, along with any applicable local government information.

- Fill out line 24 by stating the total income tax paid to the other taxing authority, ensuring you follow the specific guidelines for part-year residents and dual residency status.

- Calculate your New York State tax based on the instructions provided and enter the resulting amount on line 25.

- On line 26, round your calculation to the fourth decimal place, following the examples given.

- Complete the remaining calculations in Part 3 and Part 4 as instructed, detailing your application of credits and providing the necessary information from your return filed with the other jurisdiction.

- Once all fields have been completed accurately, save your changes in the online editor. You then have the option to download, print, or share the completed form.

Complete your It 112 R form online today to ensure you claim the tax credits you deserve.

To claim exemption under section 112A in your ITR, you must first report your long-term capital gains from the sale of equity investments. Fill in the relevant details in the designated section of your tax return, ensuring all calculations are precise. Attach any required documentation to support your claim. For a smoother experience, US Legal Forms can provide templates and resources tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.