Get New York State Tax Computation Agi Of More Than 100000 It 201 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York State Tax Computation AGI of More Than 100000 IT-201 Form online

Filling out the New York State Tax Computation IT-201 Form can be straightforward with clear guidance. This guide provides step-by-step instructions for users to easily navigate the form online, ensuring full compliance with tax obligations.

Follow the steps to complete your New York State Tax Computation Form IT-201 online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your name and Social Security number at the top of the form. Ensure that the information is accurate and matches what is on your identification documents.

- Continue to Section A where you will report your adjusted gross income. Input your total income from all sources.

- In Section B, identify any applicable deductions. Refer to the instructions provided on the form which detail qualifying deductions for your income bracket.

- Section C requires you to indicate your filing status. Select from options such as single, married filing jointly, or head of household.

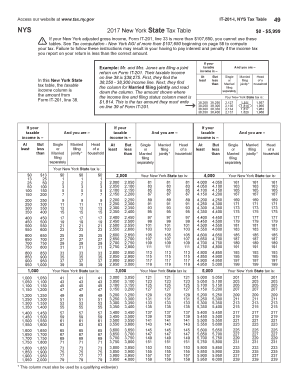

- Proceed to Section D where the tax rates apply based on your taxable income. Consult the tax table provided in the instructions to determine the correct tax amount.

- Once you have filled out all relevant sections, review your entries for accuracy. Make any necessary corrections.

- Finally, save your completed form, and choose to download, print, or share it as needed for your records.

Complete your New York State Tax Computation Form IT-201 online today to ensure timely filing and compliance.

The IT-201 form is the primary New York State income tax return form for residents. This form allows you to report your income, claim deductions, and calculate your tax liability. If your income exceeds $100,000, the New York State Tax Computation Agi Of More Than 100000 It 201 Form will be especially relevant for you. Using this form can streamline your tax filing process and ensure compliance with state regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.