Loading

Get Dtf 406

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 406 online

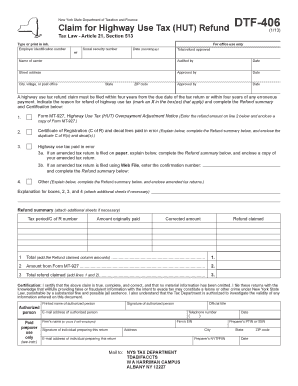

Filling out the DTF-406 form for a highway use tax refund can be a straightforward process when you have clear guidance. This guide will walk you through each section of the form, ensuring you understand the required information and how to complete it accurately.

Follow the steps to successfully complete the DTF 406 form online.

- Press the 'Get Form' button to obtain the DTF-406 form and open it in your preferred editing application.

- Begin by entering your employer identification number or social security number in the designated field. Ensure the information is accurate to avoid processing delays.

- Fill in the date (in mm/dd/yyyy format) when you submit the form. This date is vital for determining the filing period.

- Provide the name of the carrier in the specified section. Make sure to spell it correctly to prevent any issues.

- Input your street address, city, state, and ZIP code in the appropriate fields. Double-check for any errors.

- Mark an X in the box(es) that apply to indicate your reason for requesting a refund. You may choose from options like overpayment, duplicate fees, or highway use tax paid in error.

- Complete the Refund summary section. This includes entering the tax period, certificate of registration number, amounts originally paid, corrected amounts, and refund claimed.

- In the certification section, sign and date the form, including your official title and telephone number. Remember that only the taxpayer or an authorized agent may sign.

- If a paid preparer assisted in filling out the form, they should also sign it and provide their relevant identification numbers.

- Once all the sections are complete and accurate, save your changes. You may download, print, or share the completed form as required.

Complete your DTF 406 form online today to ensure your refund is processed efficiently.

You should file Form 4868 with payment to the appropriate IRS address based on your state of residence. Check the IRS official website for the most current address information. When filing related to Dtf 406, ensure that all payment details are accurate and included. Using online tax platforms can simplify this process, ensuring that your form reaches the IRS promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.