Loading

Get Ct 3m4m 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 3m4m 2012 Form online

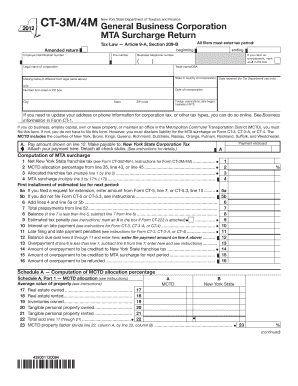

Filling out the Ct 3m4m 2012 Form online can seem daunting, but with the right guidance, it becomes a manageable task. This guide will help you navigate through each section of the form to ensure you complete it correctly and efficiently.

Follow the steps to properly complete your Ct 3m4m 2012 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax period for which you are filing. This includes both the beginning and ending dates.

- Provide your employer identification number and file number. These are essential for identifying your corporation.

- Fill in the legal name of your corporation. If your business operates under a different trade name, include that information as well.

- If applicable, input a mailing name that differs from the legal name mentioned above.

- Indicate the state or country where your corporation is incorporated.

- Provide your business telephone number and mark an X in the box if you claim an overpayment.

- Fill in the address details of your corporation, including the number and street or PO box, city, state, and ZIP code.

- For foreign corporations, indicate the date you began doing business in New York State.

- Complete the computation of the MTA surcharge by following the instructions to determine lines 1 through 16, including entering any necessary calculations.

- In Schedule A, compute your MCTD allocation percentage, filling out relevant details for property values, receipts, and payroll as required.

- Review all your entries for accuracy to ensure they are true and complete. You will need to certify your information at the end of the form.

- Once all sections are completed, you can save your changes, download a copy, print the form, or share it as needed.

Start filling out your Ct 3m4m 2012 Form online today to ensure timely and accurate submission.

Individuals who wish to claim the premium tax credit must fill out form 8962. This applies to those who have enrolled in a health plan through the Health Insurance Marketplace. If you are eligible for this credit, ensure you complete form 8962 and attach it to your CT 3M4M 2012 Form. This helps you accurately report your health coverage and claim any potential savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.