Get 2011 Rft Form - Oregon Department Of Justice - State Of ... - Doj State Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2011 RFT Form - Oregon Department Of Justice - State Of ... - Doj State Or online

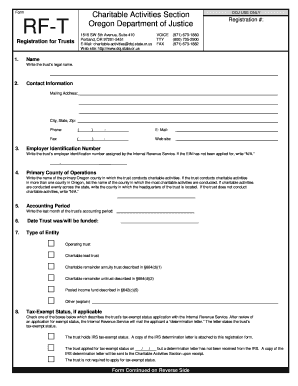

Filling out the 2011 RFT Form for the Oregon Department of Justice is an essential process for trusts conducting charitable activities in the state. This guide provides a clear, step-by-step approach to ensure users can complete the form accurately and efficiently.

Follow the steps to fill out the 2011 RFT form successfully.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Enter the legal name of the trust in the designated field.

- Provide the mailing address for the trust, ensuring to include the city, state, and zip code.

- Fill in the phone number and email address for the trust’s contact person.

- Insert the employer identification number (EIN) assigned by the Internal Revenue Service. If you do not have an EIN, write 'N/A'.

- List the primary Oregon county where the trust conducts most of its charitable activities. If applicable, explain any multi-county operations.

- Specify the last month of the trust’s accounting period.

- Indicate the date the trust was funded.

- Select the type of entity by marking the appropriate box for operating trust, charitable lead trust, charitable remainder annuity trust, or other types.

- Check the applicable box regarding tax-exempt status with the IRS, and attach any required determination letters.

- Provide contact details for an individual who can address any questions regarding this registration.

- List the names, positions, phones, and mailing addresses of each trustee in a structured format.

- Attach the required documents, including the will or trust document that created the trust and the IRS determination letter if applicable.

- Sign and date the form at the specified section, ensuring the printed name and title are included.

- Review all entries for accuracy before finalizing, and then save your changes, download, print, or share the completed form as necessary.

Complete your documents online to ensure a smooth registration process for your trust.

Registering a nonprofit organization in Oregon involves several steps. You must first file the Articles of Incorporation with the Oregon Secretary of State. After establishing your organization legally, you will then want to apply for a federal tax-exempt status, often requiring the use of the 2011 RFT Form - Oregon Department Of Justice - State Of ... - Doj State Or. For tailored guidance and templates, uslegalforms can be a valuable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.