Get Oregon Composite Return 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Composite Return 2012 Form online

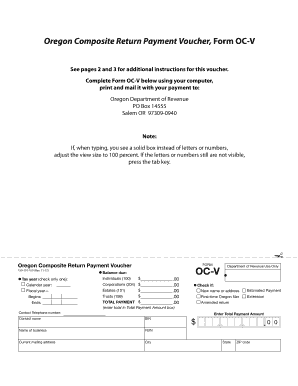

The Oregon Composite Return 2012 Form is an essential document for pass-through entities filing on behalf of nonresident owners. This guide provides clear and straightforward instructions to assist users in completing the form online effectively.

Follow the steps to fill out the Oregon Composite Return 2012 Form online.

- Click the ‘Get Form’ button to obtain the Oregon Composite Return 2012 Form and open it in your preferred online editor.

- Begin filling out the form by entering the pass-through entity's name and federal employer identification number (FEIN) in the appropriate fields at the top of the form.

- Indicate the type of pass-through entity by checking the appropriate box (e.g., LLC, S corporation) and specify the tax year.

- Fill in the total number of electing owners included in the composite return and provide details for each owner in Schedule OC1 or OC2. Include their ownership percentage and share of federal income.

- For individual owners, complete column (a) with their filing status, and in column (e), calculate the Oregon income tax based on their share of Oregon-source distributive income.

- For C corporation owners, determine the type of tax they are subject to and calculate the Oregon excise or income tax, entering it in column (e).

- If there are any payments for estimated tax, enter those amounts in the provided columns for each respective owner.

- Complete all necessary calculations and ensure that the total amounts from Schedules OC1 and OC2 are accurately reflected on the main form.

- Once all information is accurately entered, review the form for completeness and correctness before saving your changes.

- You may download, print, or share the completed form as needed, ensuring it is submitted to the Oregon Department of Revenue along with any required payments.

Begin completing your Oregon Composite Return 2012 Form online today to ensure timely filing and compliance.

The CPPR stands for Composite Partnership Payment Return, which is specifically designed for partnerships that wish to file on behalf of nonresident partners. This form is part of the Oregon Composite Return 2012 Form process, allowing for a simplified tax filing experience. By utilizing this form, you can efficiently manage tax obligations for your nonresident partners, ensuring accurate reporting and timely payments.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.