Loading

Get Mccomb Oh Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mccomb Oh Tax Form online

Filing your Mccomb Oh Tax Form online can simplify the process of reporting your income and taxes owed. Follow this guide for a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the Mccomb Oh Tax Form online:

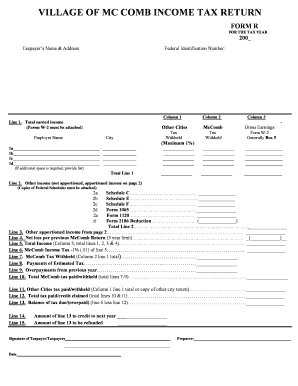

- Press the ‘Get Form’ button to acquire the Mccomb Oh Tax Form and open it in your preferred editing software.

- Enter your taxpayer’s name and address at the top of the form. This ensures proper identification.

- Fill in your federal identification number in the designated space.

- In Column 1, Line 1, input your total earned income noted from your W-2 forms. Make sure to attach these forms.

- List your employer's name and the city where you worked in Column 1.

- Record any tax withheld by your employer in Column 2.

- In Column 3, enter gross earnings as indicated in Box 5 of the W-2 form for each job. Repeat as necessary for each employer.

- If you have additional income to report, proceed to Line 2. List all types of other income and attach copies of relevant federal schedules.

- Calculate the total line 2 and enter it in the line provided.

- Include additional apportioned income from page 2, if applicable, in Line 3.

- If you have any net losses from previous McComb returns, list them on Line 4.

- Add up the total income from lines 1, 2, 3, and 4 to complete Line 5.

- Calculate the McComb income tax, which is 1% of the total income in Line 5, and enter it in Line 6.

- Record any McComb tax withheld from your employer on Line 7.

- Include your payments of estimated tax in Line 8.

- If you have had overpayments from the previous year, report these on Line 9.

- Total lines 7 through 9 to find the total McComb tax paid or withheld and place this figure on Line 10.

- If you owe tax to other cities, record this figure from your other city returns in Line 11.

- Add totals from lines 10 and 11 to complete Line 12 for total tax paid or credit claimed.

- To determine your balance of tax due or overpaid, subtract Line 12 from Line 6 and enter the result in Line 13.

- Indicate the amount you wish to credit to next year and the amount to be refunded in the designated areas.

- Finally, provide the signature(s) of the taxpayer(s) followed by the date and the preparer’s information, if applicable.

Start filling out your Mccomb Oh Tax Form online today to ensure accurate and timely submission.

The Toledo Income Tax Division requires businesses and individual sole proprietors to file copies of the 1099-MISC that they issue for their contract labor. 1099-MISC should be filed along with the business or individual Toledo tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.