Get The New Jersey Division Of Pensions & Benefits (njdpb) Cannot Provide Tax Advice

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out The New Jersey Division of Pensions & Benefits (NJDPB) Cannot Provide Tax Advice online

This guide provides detailed instructions on filling out the NJDPB Cannot Provide Tax Advice form online. By following these steps, users can easily navigate the process while ensuring they understand the implications of their retirement benefits concerning taxation.

Follow the steps to complete the form correctly

- Click ‘Get Form’ button to access the NJDPB Cannot Provide Tax Advice form and open it for editing.

- Review the introductory section of the form to understand that the NJDPB cannot provide specific tax advice. It is essential to consult a tax professional or the appropriate tax authorities if needed.

- Fill in your personal information in the designated fields. This includes your name, contact information, and retirement details.

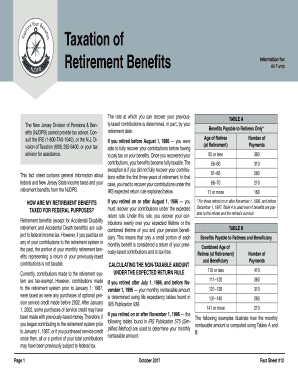

- Navigate to the section outlining how retirement benefits are taxed for federal purposes. Take note of the relevant details regarding previously-taxed contributions and your retirement date.

- Continue through the form, noting any specific examples or tables provided for calculating the nontaxable amount based on your retirement date and the type of benefits you are receiving.

- If applicable, complete the sections about withholding federal and New Jersey state income tax. Ensure to indicate if you require any changes in withholding on the appropriate forms.

- Review your completed form carefully for accuracy before final submission. Ensure all required fields are filled and that you understand the implications of the information provided.

- Once satisfied with the completion of the form, you may save changes, download a copy, and/or share it per your requirements.

Ensure you complete your tax-related documents online to streamline the process and maintain accurate records.

Related links form

You can contact the New Jersey Division of Pensions and Benefits by visiting their official website, where you will find contact information, including phone numbers and email addresses. They provide resources to help answer your questions, but keep in mind that the New Jersey Division Of Pensions & Benefits (NJDPB) Cannot Provide Tax Advice. For specific inquiries, consider reaching out directly during their business hours.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.