Loading

Get Form Fp Application For Payroll/production Credit - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FP Application For Payroll/Production Credit - Mass.Gov - Mass online

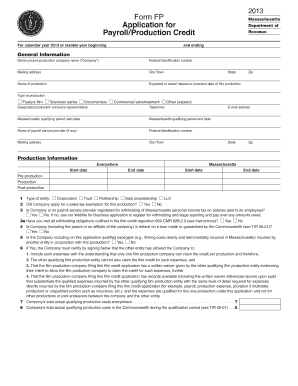

Completing the Form FP Application For Payroll/Production Credit is essential for motion picture production companies seeking tax credits in Massachusetts. This guide provides clear and supportive instructions to help you navigate each section of the form effectively.

Follow the steps to successfully complete the Form FP Application.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in the general information section, including the name of your production company, its federal identification number, mailing address, city/town, name of the production, and its expected or actual release date.

- Specify the type of production you are submitting this application for: feature film, television series, documentary, commercial/advertisement, or other. Provide detailed information if selecting 'other.'

- Designate a company representative by providing their name, telephone number, and email address.

- Indicate the Massachusetts qualifying period by entering the start and end dates.

- If applicable, fill in the payroll service provider's information, including their federal identification number and mailing address.

- Detail the production information by entering the start and end dates of the production phases (pre-production, production, post-production) in Massachusetts.

- Indicate the type of entity for the production company, and answer questions related to sales tax exemption and Massachusetts personal income tax registration.

- Certify the inclusion of expenses incurred by another entity if applicable, and confirm that you have records available for audit.

- Enter the total qualifying production costs incurred both everywhere and specifically in Massachusetts during the qualification period.

- Provide details of qualifying payroll processed through your payroll company and other payroll categories detailed in the form.

- Calculate and record payroll credits, production costs over $1,000,000, and other relevant expense details following the form's instructions.

- Finalize the form by calculating the total production credit and preparing the necessary supplementary documentation as stated in the additional requirements section.

- Once completed, review the form for accuracy. Save changes, download the final document, and ensure you print or share it according to your filing needs.

Take the next step in your application process by completing the Form FP online today.

The production expense credit may be equal to 25% of the taxpayer's Massachusetts production expenses in connection with the filming and production of a motion picture in Massachusetts. The production expense credit doesn't include payroll expenses already calculated for its payroll credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.