Loading

Get Ifta Quarterly Fuel Use Tax Return Ct - Ct.gov - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IFTA Quarterly Fuel Use Tax Return CT - CT.gov - Ct online

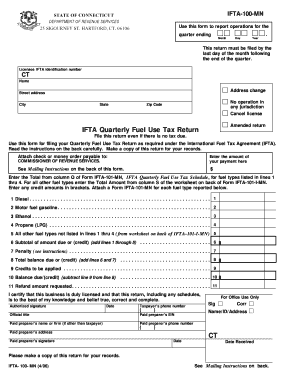

The IFTA Quarterly Fuel Use Tax Return is a crucial document for users operating under the International Fuel Tax Agreement. This guide provides comprehensive, step-by-step instructions on how to fill out this form online, ensuring your compliance with state requirements.

Follow the steps to accurately complete the IFTA Quarterly Fuel Use Tax Return CT.

- Press the ‘Get Form’ button to access the IFTA Quarterly Fuel Use Tax Return CT. This will open the form for you to complete.

- Enter the ending date of the quarter covered by this return in the designated section. This includes the month, day, and year.

- Input your IFTA license identification number as it appears on your IFTA License.

- Fill in your legal name and your complete mailing address, ensuring the accuracy of all details.

- In the appropriate lines, report your fuel usage by entering data for each fuel type reported on Form IFTA-101-MN, including diesel, motor fuel gasoline, ethanol, and propane.

- For lines 6 through 10, calculate taxes due or credits by summing amounts as detailed in the instructions for each line.

- If applicable, apply any previous credits on line 9 and adjust your balance due accordingly.

- Ensure to sign and date the return at the bottom, certifying that the information is accurate and complete.

- After completing the form, you may download, print, or share it as needed.

Complete your IFTA Quarterly Fuel Use Tax Return CT online today to ensure compliance and avoid penalties.

Keeping track of IFTA requires consistent logging of fuel purchases and mileage. Utilize spreadsheets or accounting software to record this data regularly. Additionally, platforms like US Legal Forms can provide templates and tools to streamline your IFTA Quarterly Fuel Use Tax Return CT - CT - Ct tracking process, making it easier to stay compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.