Loading

Get Form 4592

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4592 online

Filling out the Form 4592 correctly is essential for compliance with California building codes. This guide will provide you with a clear, step-by-step approach to completing the form online with confidence.

Follow the steps to fill out Form 4592 effectively.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

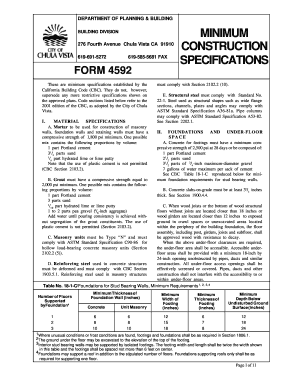

- Review the 'Material Specifications' section, where you will find required compressive strengths for materials such as mortar and grout. Ensure you select materials that meet or exceed these standards.

- Proceed to the 'Minimum Construction Specifications'. This section outlines the necessary dimensions and materials for structural steel, footings, and other construction elements. Fill out the required details based on your planned construction.

- In the 'Foundations and Under-Floor Space' section, indicate the specifications for concrete footings and slabs. Provide details on the composition and treatment of materials, ensuring they comply with the outlined standards.

- Fill in the 'Wood Framing' information, specifying the types of lumber and their grades. Pay close attention to the layout and spacing requirements for studs and beams.

- Complete the 'Weather Protection' section by noting the requirements for flashing, siding, and insulation. This ensures your structure is protected from the elements.

- Review the 'Roof Covering Materials and Application' section to specify the materials and methods for roofing. Follow the guidelines for installation carefully.

- Finally, ensure all sections are filled out accurately. Save your changes, and use options to download, print, or share the completed Form 4592 as needed.

Complete your Form 4592 online today to ensure compliance with building regulations.

Yes, you can generally deduct margin interest as long as it qualifies as an investment interest expense. To do this effectively, you should complete Form 4592 to report the margin interest accurately. Consulting resources, such as the UsLegalForms platform, can help you navigate these deductions clearly and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.