Loading

Get 2012 Ct 1040 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Ct 1040 Fillable Form online

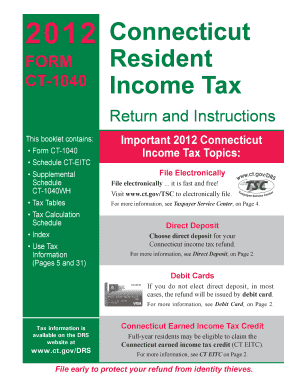

Filling out your 2012 Connecticut income tax return using Form CT-1040 can be straightforward when approached step by step. This guide is designed to help you efficiently complete the fillable form online, ensuring you capture all necessary information while maximizing potential credits.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your personal information in the designated fields. This includes your full name, address, Social Security Number (SSN), and filing status.

- Calculate your Connecticut adjusted gross income (AGI) and enter it in the appropriate section. This involves using your federal AGI and making necessary adjustments according to Connecticut tax guidelines.

- Complete the income section by including all sources of income such as wages, self-employment income, rental income, and more. Ensure that any income reported on federal forms is accurately carried over.

- Fill out any adjustments to income, including deductions or credits you are eligible for; this includes reviewing forms like Schedule CT-IT Credit.

- Review credits available such as the Connecticut earned income tax credit (CT EITC) and any property tax credits if applicable, making sure to fill out related schedules like Schedule CT-EITC.

- Check your calculations for accuracy, ensuring all entries are complete and consistent.

- Choose your refund method; if you expect a refund, you can opt for direct deposit or a debit card. Fill out the relevant section accordingly.

- Sign and date the form. If filing jointly, both partners must sign.

- Finally, save your changes, and choose to download, print, or share the completed form as required.

Get started with your 2012 Ct 1040 Fillable Form online to ensure timely and accurate filing.

To obtain a CT-1040 form, visit the Connecticut Department of Revenue Services website or use platforms like US Legal Forms. They provide easy access to the 2012 Ct 1040 Fillable Form, which you can fill out online or print. This ensures you have the necessary documentation to complete your state income tax filing accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.